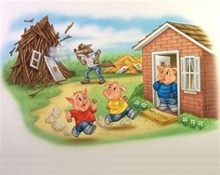

April is Financial Literacy Month. What can a children’s fable teach us about personal finances after 12 months of CoVid-19 pandemic, economic disasters, and homing schooling our kids? A lot, it turns out. Recall that the three brother pigs set out to make their fortunes. One built a house of straw, one a house of sticks and one a house of bricks. Then, reflect next back to February 2020. If you knew then what you know now, would you rather have been the free-willing pig with the straw house or his wiser brother with the brick house?

The wolf arrived as the CoVid-19 pandemic, shuttering businesses and our lives and sending the stock market into a tailspin. When the first pig lost his job in the service industry, he could not pay his rent, car loan and credit card bills, and was out on the street. Next the economic train wreck forced the second little pig to close his small business. Income gone, he used up his meager savings to pay his mortgage, credit cards, and his truck and trailer loans. He also panicked and sold all his retirement investments at the bottom of the stock market crash in early April 2020. Desperate and nearly broke, he stopped paying on everything and lost his house.

However, the third little pig weathered the storm just fine. While he too was temporarily laid off and watched his retirement investments plummet in April 2020, he didn’t panic because he had zero personal debt, he had six months of emergency savings, he had paid off the mortgage on his brick house, and he knew that what goes down in the stock market must come back up. In April 2021, even though his children continue do homeschool by “Zoom” from his brick house, he still has no debt, he has rebuilt his emergency savings, his 401 (K) is at record highs, and he is living his American dream.

We face an epidemic of financial stress across America. The facts are staggering. While the stock market reached all-time highs in mid-March 2021, after hitting rock bottom in April 2020, 75 percent of Americans live paycheck to paycheck, if they even have a paycheck.

- Almost 69 percent do not have $1000 in the bank and therefore cannot pay for a simple emergency like new brakes or repairing the dishwasher.

- Credit card debt consumes wealth, with Americans averaging over $6000 in debt and paying an average of over 16 percent interest.

- Utahns rank the 10th worst in the nation for total personal debt and have an average of over $31,100 in student loans.

- Over half of Americans over 55 years old have zero retirement savings!

Financial stress effects everyone – the rich, the poor and the middle class.

- It is the leading cause of relationship issues and divorce.

- It causes significant health and emotional issues, including anxiety, depression, alcohol/substance abuse and, sadly, suicide.

- Financially stressed people face embarrassment, humiliation, shame and fear as they struggle to deal with how to communicate with their spouses, how to pay the bills, how to reply to creditors, how to set realistic goals and save for the future

- It is a leading cause of workplace stress, with 37 percent of Millennials, 34 percent of GenXers and 16 percent of Baby Boomers distracted by their finances while at work.

- Financially stressed employees miss twice as many days of work.

Finding financial peace is 80 percent behavioral related and only 20 percent head knowledge. Personal financial coaches help people reduce their financial stress and find financial peace, thereby improving overall wellness and increasing employee productivity. Financial coaches guide, teach and train people on:

- How to understand the root causes of their financial stress.

- How to set aside the cultural money messages for a moment and focus on what is important to individuals and their families in order to plan and set goals for the future.

- How to budget and live within one’s means, to save for emergencies, and to get rid of suffocating personal debt including student loans.

- How to save for retirement, fund their children’s future education, buy a house, and live their America Dream.

- How to find financial peace and end financial stress for good.

The Big, Bad Wolf will come again. What House do you want to be living in a year from now?

About A Helping Hand Financial Coaching

A Helping Hand Financial Coaching is a service-disabled, veteran-owned small business in Weber County, owned and operated by Don Hickman. Don is a Dave Ramsey certified Master Financial Coach. He helps turn financial nightmares into American dreams and financial stress into financial peace. Don has helped hundreds of small businesses, individuals and couples better understand their relationship with their money, learn to live on less than they make, to plan and create wealth for their futures, and live and thrive in that “brick house”.

Contact information:

Office Phone: (385) 244-0395

Email: thehickmangroupllc@gmail.com

Book a free, no-obligation financial consultation: https://ramseycoach.com/Don-Hickman

Discount: 20% off five (5) Financial Coaching Sessions booked before 5/31/2021